In today’s dynamic work environment, it’s more important to pay close attention to employee wellbeing especially if you are in the service business. With so much talk about Artificial Intelligence and Process Automation, the human interface in several businesses is still the difference maker and just like Shep Hyken said “The greatest technology in the world hasn’t replaced the ultimate relationship building tool between a customer and a business; the human touch.”

It’s on this note therefore that every employer should carry out an audit into their respective employee benefits plan currently in place to assess its compatibility with the bulk of the critical work force.

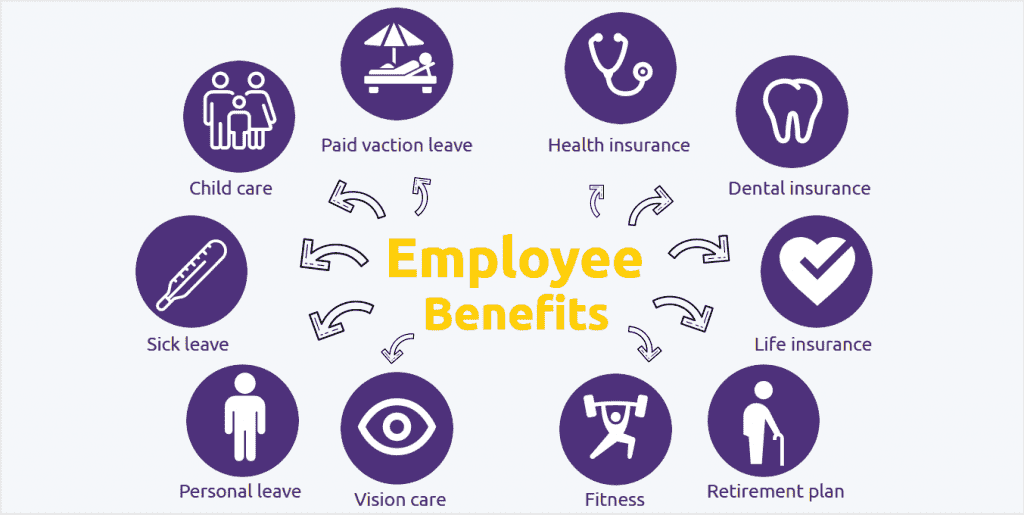

Employee benefits are much broader than the monthly pay, but extends to many other incentives available to boost job satisfaction from your employees; the program designs begins with a critical analysis of the hobbies, age group, gender distribution, family size, future aspirations to craft an appropriate employee benefits plan for your most valuable assets.

Many business leaders perceive employee benefits as an expense, and so goes the corporate dilemma caught in a discussion between two Senior Executives of a Consultancy firm i.e. an HR Manager and Risk Manager; Risk Manager asks “what if we train all these people and they leave us within the next three years” to which the HR Manager responds, “what if we don’t offer them any training and they stay.”

This discourse underpins the importance of viewing employee benefits as an investment, rather than an expense, and this investment is so crucial that if its not made, your staff can easily turn into a liability.

With one of the youngest workforces in the world, employers need to go beyond the provision of competitive salaries, gratuity plans, and retirement packages and update their benefit offerings to cater to the impowered ‘boomers’ generation who are more exposed than the millennials and prior generations.